Work From Home

More Changes and More Substantiation for WFH “Running” Expenses

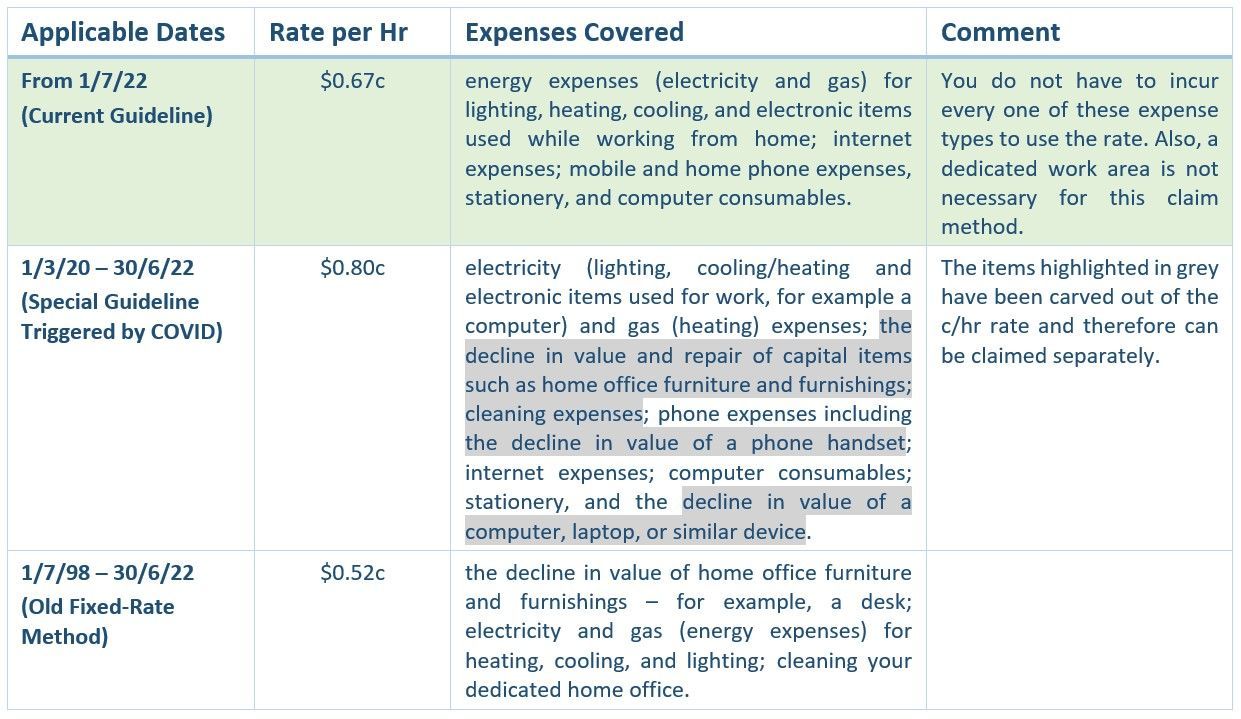

The ATO and Treasury are clearly worried about escalating deduction claims for home office operating expenses, triggered by the Work from Home (WFH) trend. They released a new set of guidelines (PCG 2023/1) in February this year with retrospective operation to 1/7/22. These guidelines are offered as an alternative to accounting for and substantiating actual home office costs. Briefly, the history of these shortcut methods allowed by the ATO is as follows:

SUBSTANTIATION: Use of these rates requires the following minimum substantiation:

- A time record of hours worked recorded in a diary, timesheet, or roster for example.

- At least one bill showing you incurred energy, mobile, or telephone, and internet expenses.

- At least one receipt showing you incurred occasional expenses such as stationery and computer consumables.

TIP: You will note that these shortcut methods do not include any ‘occupancy’ expenses such as rent, rates, home loan interest, and insurance, for example. A higher threshold of necessity is required to trigger these “place of business” style claims. Such claims are possible where an enterprise is operated from home or in situations where an employee does not have an alternative workspace available. This concept is considered in TR 93/30. It is important to note that claiming place of business style expenses can interfere with your ability to claim full CGT Main Residence Exemption for your home.

ACTION:

Home office work from home claims are potentially worthwhile. It is best to come up with a game plan early and keep receipts (take a photo of them or use an app) and record home office hours in a way that is easiest for you.